Sequoia Capital Bets Big on Anthropic, Defying Investment Norms

In a surprising move that’s sending shockwaves through Silicon Valley, Sequoia Capital is reportedly joining a massive funding round for Anthropic, the AI startup known for its AI model, Claude. This news comes from a recent report by the Financial Times, and it’s raising eyebrows among industry veterans.

Breaking Investment Patterns

Traditionally, venture capital firms tend to avoid investing in competing companies within the same field, often choosing to support just one standout competitor. However, Sequoia is now diversifying its investments, having already backed both OpenAI and Elon Musk’s xAI, and is now adding Anthropic to its portfolio.

Timing Raises Questions

The timing of this investment is particularly intriguing, especially in light of comments made under oath last year by OpenAI’s CEO, Sam Altman. While testifying in a lawsuit involving Musk, Altman addressed rumors surrounding investor restrictions in OpenAI’s future funding rounds. He noted that investors who had access to OpenAI’s confidential data were informed that this access would end if they made active investments in rival companies—something he labeled as “industry standard” protection.

A Major Funding Round

According to the Wall Street Journal and Bloomberg, the funding round, which Sequoia is joining, is being led by Singapore’s GIC and U.S. investment firm Coatue, both contributing $1.5 billion. Anthropic aims to raise upwards of $25 billion, with a whopping $350 billion valuation—more than double its previous valuation of $170 billion just four months ago. Microsoft and Nvidia are collectively committing up to $15 billion, with additional VC investors expected to contribute another $10 billion or more.

Sequoia’s Deep Connection to Altman

Sequoia’s connection to Altman runs deep. When Altman left Stanford to kick off his entrepreneurial journey with Loopt, Sequoia was there to support him. He eventually became a “scout” for the firm and played a role in introducing them to Stripe, one of their most successful investments. The new co-leader at Sequoia, Alfred Lin, also has a history with Altman, having interviewed him multiple times at various events. Interestingly, even after Altman’s brief ousting from OpenAI in November 2023, Lin publicly expressed interest in backing Altman’s “next world-changing company.”

Shifting Landscape and Historical Context

Sequoia’s decision to invest in Anthropic breaks from its historical stance on portfolio conflicts. Notably, in 2020, the firm withdrew from its investment in payments company Finix upon realizing it competed directly with Stripe, ultimately walking away from a $21 million investment in the process. This marks a significant shift in Sequoia’s investment strategy and raises questions about the direction they’re heading in.

Recent Changes at Sequoia

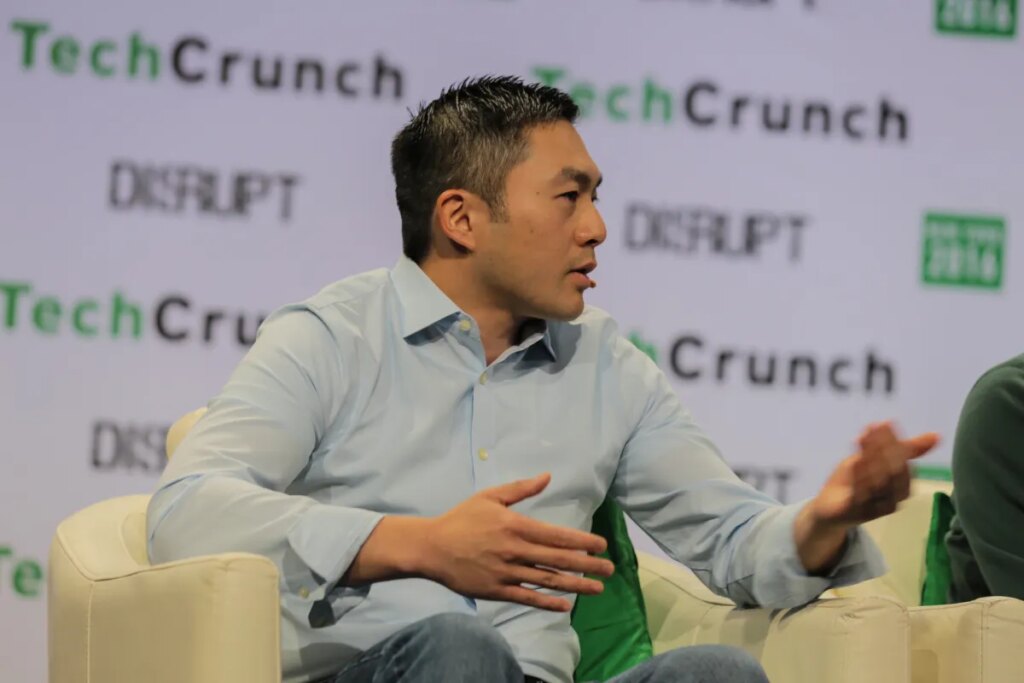

This investment comes amid recent upheavals at Sequoia. The firm’s global steward, Roelof Botha, was unexpectedly voted out just weeks ago, shortly after engaging with industry experts at TechCrunch Disrupt. Lin and Pat Grady, who previously managed the Finix deal, have taken over leadership responsibilities.

Future Outlook for Anthropic

Looking ahead, Anthropic is reportedly gearing up for an initial public offering (IPO) that could occur as soon as this year. As the AI landscape continues to evolve, this funding round with Sequoia’s backing signals a potential reshaping of industry dynamics.

In Summary

The involvement of Sequoia Capital in Anthropic’s funding round marks a crucial turning point in venture capital investment strategies, showcasing a willingness to support multiple companies in the rapidly growing AI sector. As the landscape shifts, all eyes will be on the developments from Anthropic, especially with an IPO on the horizon. For more updates on technology and finance, visit Axom Live.